Crypto Exchange Withdrawal Fees: 7 Powerful Ways to Slash Costs 2025

Understanding the Real Cost of Moving Your Crypto

Crypto exchange withdrawal fees are charges you pay when transferring cryptocurrency from an exchange to your wallet or another platform. These fees vary widely across exchanges and cryptocurrencies, significantly impacting your bottom line.

For quick reference, here are typical withdrawal fees for popular cryptocurrencies across major exchanges:

| Cryptocurrency | Binance | Coinbase | Kraken | MEXC |

|---|---|---|---|---|

| Bitcoin (BTC) | 0.00015 BTC (~$8) | 0.0005 BTC (~$28) | 0.00001 BTC (~$1.06) | 0.0001 BTC (~$5.60) |

| Ethereum (ETH) | 0.003 ETH (~$7) | 0.005 ETH (~$12) | 0.005 ETH (~$12) | 0.001 ETH (~$2.40) |

| USDT (Tether) | 1 USDT on ERC20 | 5-15 USDT | 2.5 USDT | 1 USDT |

| Solana (SOL) | 0.01 SOL (~$1) | 0.01 SOL (~$1) | 0.01 SOL (~$1) | 0.01 SOL (~$1) |

When you withdraw crypto, you’re not just paying the exchange – you’re primarily covering the blockchain network fees that go to miners or validators. These fees can eat into your holdings, especially for smaller transactions or during periods of high network congestion.

The difference between paying 0.00001 BTC versus 0.0005 BTC might seem small, but at current prices, that’s a difference of over $25 per withdrawal. For active traders making frequent withdrawals, these fees can quickly add up to hundreds or even thousands of dollars annually.

In this guide, we’ll explore how withdrawal fees work, which exchanges offer the lowest fees, and practical strategies to minimize these costs so you can keep more of your hard-earned crypto.

Common crypto exchange withdrawal fees vocab:

– best crypto exchange

– blockchain for digital identity

Understanding Crypto Exchange Withdrawal Fees

When you decide to move your cryptocurrency from an exchange to your personal wallet or another platform, you encounter what we call crypto exchange withdrawal fees. These fees represent a critical aspect of cryptocurrency management that many newcomers overlook until they see their first withdrawal amount.

What Are Withdrawal Fees & Why Do They Exist?

Crypto exchange withdrawal fees exist primarily to cover the cost of processing your transaction on the blockchain network. Unlike traditional banking systems, blockchain transactions require computational work performed by miners or validators who maintain the network.

When you initiate a withdrawal, here’s what happens:

- Your transaction joins a queue of pending transactions

- Miners or validators select transactions to include in the next block

- They prioritize transactions with higher fees

- Your crypto moves from the exchange’s wallet to your destination address

The fee you pay is split into two components:

– Network fee: Paid to miners/validators (the majority of the cost)

– Exchange fee: Sometimes added by exchanges as an additional service charge

As explained in Binance Academy’s research on cryptocurrency mining, these miners and validators perform essential security functions, preventing double-spending and maintaining the integrity of the blockchain. Your withdrawal fee directly supports this security infrastructure.

Withdrawal fees differ from trading fees. While trading fees (maker/taker fees) apply when buying or selling crypto on an exchange, withdrawal fees only apply when moving assets off the exchange.

Fixed vs Dynamic Fees on Exchanges

Crypto exchange withdrawal fees typically fall into two categories:

Fixed Fees:

– Set amount regardless of transaction size

– Example: 0.0005 BTC withdrawal fee on Coinbase

– Predictable but potentially expensive for small withdrawals

– Often used by centralized exchanges

Dynamic Fees:

– Fluctuate based on network congestion

– Directly reflect current blockchain conditions

– May offer priority options (pay more for faster processing)

– Common with decentralized exchanges and some centralized platforms

Many exchanges now implement a hybrid approach. They might have a base fee that adjusts within a range depending on network conditions. During periods of extreme congestion, fees can increase dramatically – sometimes by 5-10x their normal amounts.

Some exchanges also offer priority options where you can choose between:

– Economy (slower, cheaper)

– Standard (average speed and cost)

– Priority (faster, more expensive)

For example, during Ethereum network congestion, the difference between economy and priority withdrawals might be as much as 20-30 GWEI (the unit for Ethereum gas prices), translating to several dollars in fee difference.

Minimum Withdrawal Amounts & Hidden Costs

Beyond the explicit crypto exchange withdrawal fees, you should be aware of minimum withdrawal thresholds and potential hidden costs:

Minimum Withdrawal Amounts:

Most exchanges impose minimum withdrawal amounts for each cryptocurrency. These minimums serve two purposes:

1. Prevent dust attacks (tiny transactions that can clog the network)

2. Ensure the withdrawal fee doesn’t consume a disproportionate percentage of the transaction

For example, Binance’s minimum BTC withdrawal is 0.001 BTC – roughly $56 at current prices. If you’re withdrawing exactly this minimum amount and paying their 0.00015 BTC fee, you’re effectively paying a 15% fee.

Small-Balance Traps:

If you have a balance below the minimum withdrawal threshold, your funds can become effectively trapped on the exchange. This is particularly problematic for:

– Airdrops or small rewards

– Dust from multiple trades

– Leftover amounts after major withdrawals

Dormancy/Inactivity Fees:

Some exchanges charge inactivity fees if your account remains dormant for extended periods. These fees can gradually erode small balances, making them even harder to withdraw.

Conversion Costs:

If you need to convert a small balance to a different cryptocurrency with lower withdrawal minimums, you’ll incur trading fees for the conversion – another hidden cost.

How Fees Differ Across Coins & Platforms

The world of crypto exchange withdrawal fees is incredibly varied – what you’ll pay depends hugely on both the cryptocurrency you’re moving and the platform you’re using. Understanding these differences isn’t just interesting – it can save you real money every time you move your assets.

Bitcoin vs Ethereum vs Solana: A Quick Fee Snapshot

Bitcoin might be the king of crypto, but it’s certainly not the cheapest to move around. BTC withdrawal fees range from as low as 0.00001 BTC on Kraken (about $1) to a hefty 0.0005 BTC on Coinbase (around $28). That’s a massive difference for the exact same transaction! When the Bitcoin network gets busy, these fees can spike even higher, though innovations like Segwit and the Lightning Network have helped ease the pain somewhat.

Ethereum presents its own challenges with those notorious gas fees that seem to have a mind of their own. Most exchanges charge between 0.001 ETH (MEXC) and 0.005 ETH (Coinbase and Kraken) to withdraw. What makes ETH particularly tricky is how wildly these fees fluctuate based on network traffic – one day it might cost $5, the next day $50! This is where Layer-2 solutions like Arbitrum and Optimism come in handy, offering significantly cheaper alternatives.

Solana, on the other hand, is refreshingly consistent. Most exchanges charge around 0.01 SOL (roughly $1) to withdraw, and this fee stays pretty stable even during busy periods. If you’re looking for predictable, low-cost withdrawals among the major cryptocurrencies, SOL is tough to beat.

Stablecoins like USDT (Tether) present a unique situation because they exist on multiple blockchains. Withdraw USDT on the Ethereum network (ERC-20), and you might pay anywhere from 1-15 USDT. Choose the Tron network (TRC-20) instead, and your fee drops below 1 USDT. Binance Smart Chain (BEP-20) typically charges around 0.8-1 USDT. Same asset, very different costs!

When it comes to altcoins, it’s a mixed bag. Some are surprisingly affordable to move (XRP typically costs around 0.25 XRP), while others might charge fees that seem disproportionately high compared to their value.

Centralized vs Decentralized Exchanges

The type of exchange you use fundamentally changes how crypto exchange withdrawal fees work. Centralized exchanges (CEXs) like Binance, Coinbase, and Kraken typically set fixed withdrawal fees that they update periodically. Here’s the thing though – they’re often charging you more than the actual network cost, adding their own markup as a profit margin. You’re paying for convenience and simplicity, but it comes at a price.

Decentralized exchanges (DEXs) work differently. When you use Uniswap, dYdX, or Curve, you’re not paying a “withdrawal fee” per se – you’re paying the actual network gas fee directly. These adjust in real-time based on network conditions, which means you might pay less during quiet periods, but potentially much more during peak times.

The practical difference? Let’s say you want to move some ETH. A centralized exchange might charge you a flat 0.003 ETH (~$7) regardless of network conditions. Meanwhile, moving that same ETH between wallets via a DEX might cost only 0.001 ETH (~$2.40) in gas fees during normal conditions – but could spike much higher during busy periods.

For more guidance on finding the right exchange for your particular needs, our detailed guide on the best crypto exchange can help you make an informed choice.

Exchanges With the Lowest or Zero Fees

Not all exchanges are created equal when it comes to crypto exchange withdrawal fees, and some offer surprisingly good deals:

MEXC consistently offers some of the lowest withdrawal fees across major cryptocurrencies, while Kraken has an impressively low BTC withdrawal fee at just 0.00001 BTC. Bitfinex stands out by offering completely free withdrawals for certain coins like Dogecoin and XRP.

Some exchanges run special promotions where they temporarily waive withdrawal fees entirely. Phemex and MEXC are known for these zero-fee periods, and Binance sometimes does the same for newly listed coins. It’s worth keeping an eye out for these promotions if you’re planning a large withdrawal.

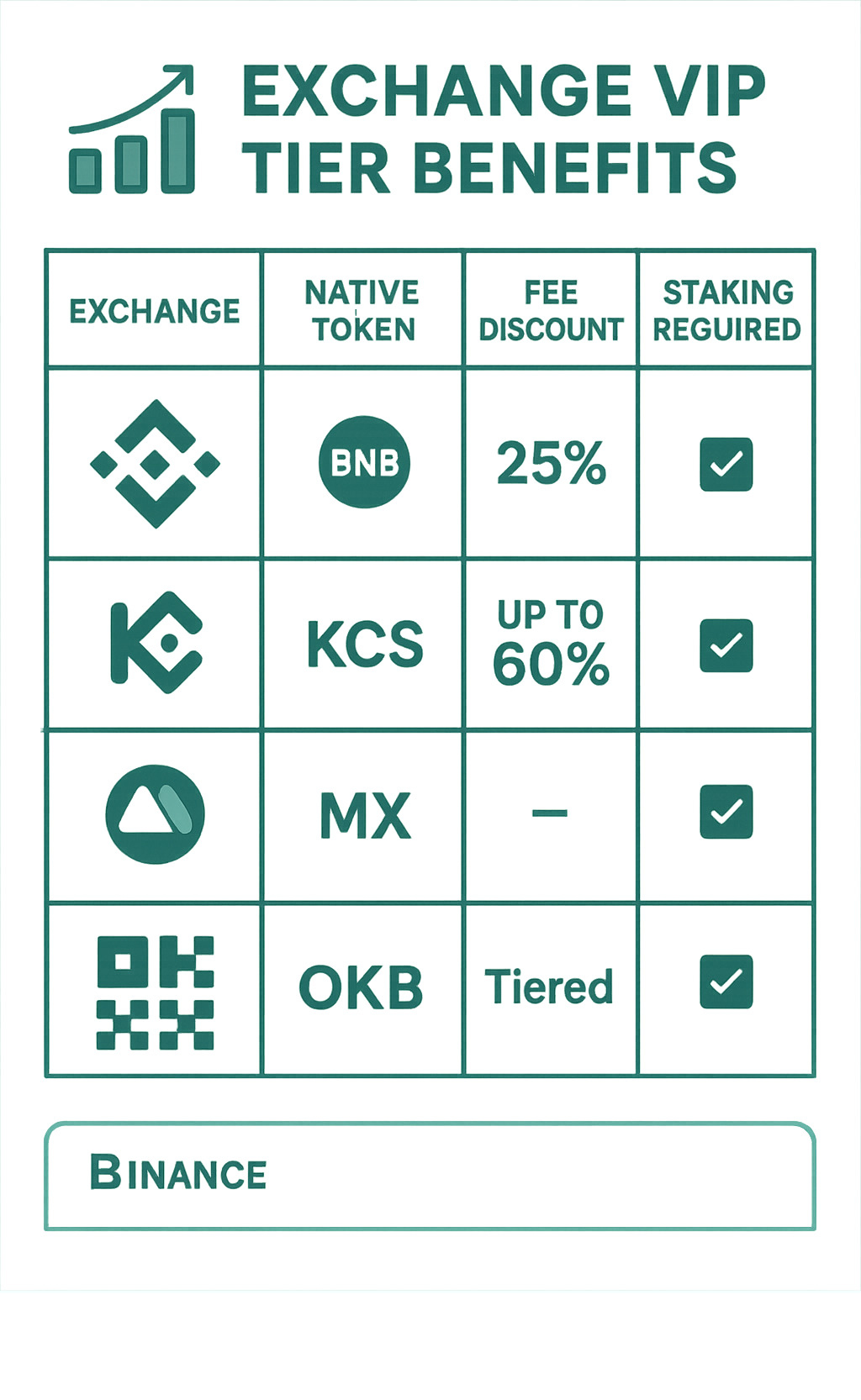

Many exchanges also offer discounts when you use or hold their native tokens. Binance users can get a 25% reduction on withdrawal fees by using BNB, while KuCoin offers KCS holders fee discounts up to a whopping 60%. Similarly, staking OKB on OKX can substantially reduce what you’ll pay to withdraw.

For the high rollers among us, VIP tiers can make a significant difference. Most major exchanges offer reduced withdrawal fees for traders moving serious volume – typically starting at $50,000-$100,000 monthly. The top tiers can enjoy discounts of up to 50% off standard withdrawal fees, which adds up quickly if you’re making frequent withdrawals.

The bottom line? Where you withdraw from matters almost as much as what you’re withdrawing. Taking a few minutes to compare fees across different platforms before moving your crypto could save you substantial money in the long run.

Smart Strategies to Minimize or Avoid High Fees

Let’s face it – nobody enjoys paying fees when moving their crypto around. The good news? With a few clever tactics, you can dramatically reduce those pesky crypto exchange withdrawal fees and keep more of your digital assets where they belong – in your wallet.

Use Cheaper Networks or Layer-2 Bridges

One of the simplest ways to slash your withdrawal costs is to be strategic about which blockchain network you use. This is especially powerful when dealing with multi-chain tokens like stablecoins.

Take USDT (Tether) as an example. You could withdraw it as an ERC-20 token on Ethereum and pay eye-watering fees during busy periods, or choose the TRC-20 version on Tron and pay pennies instead. The difference can be stunning – perhaps 1 USDT versus 15 USDT in fees, saving you 93% instantly!

The same principle applies to many popular tokens:

Ethereum (ERC-20) is like taking a luxury limousine – prestigious but expensive. Tron (TRC-20) and Binance Smart Chain (BEP-20) are more like taking an Uber – they’ll get you there just fine at a fraction of the cost. Solana (SPL) is even more efficient, with consistently tiny fees.

Layer-2 solutions offer another fantastic way to cut costs. Think of these as express lanes built on top of congested highways. Arbitrum and Optimism work wonderfully for Ethereum assets, while the Lightning Network does the same for Bitcoin. Polygon offers super cheap transactions while maintaining Ethereum compatibility.

If your exchange doesn’t directly support your preferred network, don’t worry! You can use cross-chain bridges as a workaround. Sometimes withdrawing to one network and then bridging to another yourself ends up cheaper than a direct withdrawal. It’s like taking a connecting flight instead of a direct one because the total fare is lower.

For a deeper dive into these technologies, check out our comprehensive blockchain technology guide.

Batch & Schedule Withdrawals During Low Congestion

Timing really is everything when it comes to crypto exchange withdrawal fees. Blockchain networks have their own rush hours and quiet periods – and prices vary accordingly.

Weekend mornings (especially Sundays) typically see the lowest fees, while weekday afternoons during Asian trading hours often experience the highest congestion. It’s similar to how airline tickets cost less during off-peak seasons.

Rather than making several small withdrawals, try batching them into one larger transaction. The math speaks for itself – five separate 0.1 BTC withdrawals might cost you 0.0005 BTC in total fees, while one 0.5 BTC withdrawal costs just 0.0001 BTC. That’s an 80% savings just by being patient and strategic!

For the truly fee-conscious, consider using mempool monitoring tools to watch network congestion in real-time. Sites like mempool.space for Bitcoin and etherscan.io/gastracker for Ethereum let you see exactly when fees drop to their lowest levels.

Some exchanges update their fixed withdrawal fees periodically based on network conditions. If you notice an exchange’s fees seem unusually high compared to current network rates, it might be worth waiting for their next adjustment, or temporarily converting to a different crypto with lower withdrawal costs.

Native Token & VIP Discount Hacks

Exchange tokens aren’t just for trading – they’re powerful tools for slashing your crypto exchange withdrawal fees. Think of them as membership cards that give you special privileges.

Binance offers a 25% discount when you pay fees with BNB. KuCoin takes it even further, with up to 60% off when you hold their KCS token. MEXC and OKX have similar programs with their MX and OKB tokens respectively.

Staking these tokens often open ups even better benefits. With relatively modest stakes (typically $100-$5,000 worth), you can secure significant fee reductions across both trading and withdrawals. The lock-up periods are usually reasonable too – often just 7-30 days.

Some exchanges even offer fee rebates, essentially returning some of your fees as rewards. These might be volume-based for active traders, special promotions for new users, or perks from referral programs.

If you’re a high-volume trader, pay special attention to VIP program thresholds. Sometimes you’re just a little short of qualifying for the next tier with substantially better fee structures. In these cases, it might be worth temporarily increasing your trading activity or holding additional exchange tokens to reach that next level before making large withdrawals.

By combining these strategies – choosing efficient networks, timing your transactions wisely, and leveraging exchange tokens – you can dramatically reduce what you pay in crypto exchange withdrawal fees over time. Your future wallet will thank you!

Tax & Legal Considerations

Beyond just hitting your wallet directly, crypto exchange withdrawal fees also come with some important tax and legal implications that smart crypto users need to understand.

Are Withdrawal Fees Tax-Deductible?

Good news – in many countries, you can actually offset those pesky withdrawal fees when tax time rolls around. While tax laws vary worldwide, here’s what typically applies:

When you’re calculating your crypto gains and losses, withdrawal fees aren’t just money down the drain. You can usually add these fees to your cost basis or subtract them from your proceeds when you sell. This effectively lowers your taxable capital gains.

For example, if you bought Bitcoin at $20,000 and paid a $10 withdrawal fee to get it to your wallet, your actual cost basis becomes $20,010. That extra $10 might not seem like much, but for frequent traders making multiple withdrawals, these fees can add up to significant tax savings over time.

For those of you who qualify as businesses for tax purposes (day traders and professional investors), these crypto exchange withdrawal fees might be fully deductible as business expenses. The rules here get pretty complex though, so it’s worth chatting with a crypto-savvy tax professional who understands your specific situation.

The key to making this work is keeping meticulous records. Save those confirmation emails, take screenshots of withdrawal transactions, and document both the crypto amount and the equivalent fiat value at the time of each withdrawal. Many crypto tax software platforms now automatically factor in these fees, which can save you a massive headache when preparing your tax returns.

Compliance, KYC & Security Risks

The regulatory world of crypto is constantly evolving, creating a complex landscape for withdrawals:

Most legitimate exchanges now require some form of identity verification (KYC) before you can withdraw your crypto. The more personal information you provide, the higher your withdrawal limits typically become. It’s a trade-off between privacy and convenience that every crypto user needs to weigh.

Some platforms do offer withdrawals without identity verification, but I’d approach these with caution. While the allure of privacy is strong, these services often come with significant downsides: potential legal issues in countries requiring KYC compliance, higher risks of the exchange suddenly disappearing with your funds, or the possibility of having your assets frozen if the exchange later implements KYC requirements.

Security is another crucial consideration when looking at crypto exchange withdrawal fees. Sometimes, lower fees come at the cost of weaker security measures. That bargain withdrawal rate might seem attractive until you’re dealing with a hacked account or unresponsive customer service. The cheapest option isn’t always the safest home for your hard-earned crypto.

International withdrawals add another layer of complexity. Some countries have started restricting crypto movements to foreign exchanges, and the tax reporting requirements can differ dramatically when moving assets across borders.

For those considering accountless exchanges, just know that while you might save a few dollars on fees, the regulatory and security risks could potentially cost you much more in the long run.

The world of crypto continues to mature, and staying on the right side of regulations while minimizing costs requires balancing multiple factors. Being aware of both the direct costs and these broader implications will help you make smarter decisions about when, where, and how to move your digital assets.

Frequently Asked Questions about Crypto Exchange Withdrawal Fees

Do any exchanges really offer free crypto withdrawals?

Yes, free crypto withdrawals do exist in the wild – but like most things that sound too good to be true, there are some important details to consider.

Some exchanges like MEXC and Phemex run special promotional periods where they’ll waive withdrawal fees entirely for certain coins. It’s like those “free shipping” weekends from your favorite online retailer – they don’t happen often, but they’re worth watching for!

Several exchanges also offer permanently free withdrawals for specific cryptocurrencies. Bitfinex, for example, lets you withdraw Dogecoin, XRP, and several other coins without fees. If you’re a fan of these particular assets, this could save you a bundle over time.

For the high rollers among us, VIP programs on platforms like Binance and OKX include free withdrawals on select cryptocurrencies as one of their perks. The catch? You’ll need to be trading some serious volume to qualify.

Finally, some exchanges don’t charge extra when withdrawing coins on their native blockchains – like BNB on Binance Chain. They’re essentially just passing along the minimal network costs.

That said, I should be straight with you – no major exchange offers completely free withdrawals across all cryptocurrencies all the time. Even when withdrawals are marketed as “free,” the exchange is typically covering the network fee themselves and making up for it elsewhere through trading fees or spreads. There’s no free lunch in crypto!

Are fiat withdrawal fees higher than crypto fees?

Comparing crypto exchange withdrawal fees to traditional fiat withdrawal costs is a bit like comparing apples and oranges – it really depends on the circumstances.

Traditional banking methods vary widely in cost:

– Wire transfers often hit you with hefty $25-50 flat fees

– ACH/SEPA transfers can be free or very inexpensive ($0-5)

– Credit/debit card refunds typically don’t cost you anything but can take days to process

– PayPal and similar services usually charge between 0.5-3% of the transaction

For small withdrawals under $1,000, ACH or SEPA transfers are usually your best bet, often beating crypto withdrawal costs. But when you’re moving larger sums – especially internationally – cryptocurrency really shines.

Here’s a real-world example: imagine you need to send $20,000 internationally. A traditional wire transfer might cost you $50 and leave you waiting 3-5 business days. The same transaction using USDT on the TRC-20 network would cost around $1 and complete in about 30 minutes. That’s not just a cost difference – it’s a completely different experience!

Time-sensitive transfers almost always favor crypto, regardless of the amount. If you need money moved quickly, waiting days for a bank transfer just doesn’t cut it anymore.

Where can I find real-time withdrawal fee data?

Staying on top of current crypto exchange withdrawal fees is crucial if you want to keep more of your digital assets. Here are the best resources to keep handy:

The most straightforward approach is to check exchange fee pages directly. Most platforms maintain dedicated sections listing their current withdrawal fees, though these may not always reflect real-time network conditions during periods of congestion.

For comparing fees across multiple platforms, websites like CryptoFees.io are invaluable. They aggregate data from various exchanges and networks, making it easy to spot which platform offers the best deal for your particular coin.

When network congestion is a concern, blockchain explorers provide the most up-to-date information. For Bitcoin, check mempool.space; for Ethereum, etherscan.io/gastracker is your friend; and for a broader view, blocknative.com covers multiple chains.

During extreme market volatility, don’t forget to check exchange status pages. These often contain announcements about temporary fee adjustments that might not be reflected in their standard fee tables.

Community resources can also be goldmines of information. Reddit communities like r/BitcoinFees and Discord servers for specific exchanges often share real-time fee data and tips for avoiding high costs.

In the crypto world, fees can change in the blink of an eye – especially during market volatility or network congestion. Always double-check the current fee before making any significant withdrawal. A few seconds of research could save you a meaningful amount of your hard-earned crypto!

Conclusion

Let’s face it – those crypto exchange withdrawal fees can really add up if you’re not careful. After diving deep into this topic, I hope you’ve gained some practical insights that will help keep more of your hard-earned crypto where it belongs – in your wallet!

Think about it: the difference between paying attention to these fees and ignoring them could mean hundreds or even thousands of dollars saved each year. That’s not pocket change for most of us!

By putting the strategies we’ve discussed into practice, you can become much smarter about how you move your crypto:

First, take the time to research and choose the right exchange for your most commonly withdrawn cryptocurrencies. The fee differences between platforms can be dramatic – why pay a 0.0005 BTC fee when another reputable exchange charges just 0.00001 BTC?

When dealing with tokens like USDT that exist on multiple blockchains, selecting the optimal network can slash your fees by up to 95%. That TRC-20 option might just become your new best friend!

One of my favorite tips is to batch your withdrawals whenever possible. Instead of making five small transfers throughout the week, combining them into one larger withdrawal can save you from paying the same fee multiple times. It’s simple math that adds up quickly.

Learning to time your withdrawals during network lulls (hello, Sunday mornings!) can help you avoid those painful congestion-related fee spikes. Just a little patience can go a long way.

Don’t overlook the potential savings from leveraging native tokens like BNB or KCS. That 25-60% fee reduction might seem small on a single transaction, but for frequent traders, it’s a game-changer over time.

And remember to consider the tax implications when planning your withdrawal strategy. Those fees might be deductible or could adjust your cost basis – definitely worth discussing with your tax professional!

While hunting for the lowest fees is smart, don’t sacrifice security or compliance in the process. The cheapest option isn’t always the best if it means putting your funds at risk or creating headaches with regulators down the road.

Here at The Techie Genius, we’re passionate about helping you steer the sometimes confusing world of cryptocurrency with practical advice you can actually use. Whether you’re just starting out or you’ve been in the crypto game for years, understanding these fees is an essential part of your journey.

For more helpful resources on cryptocurrency and other tech topics, check out our tech glossary with 20 common terms everyone should know.

What about you? Have you found clever ways to minimize your withdrawal fees? We’d love to hear your experiences in the comments below!